Personal Income Tax that Expatriates Working In Vietnam Should Know

When coming to live or work in another locality or country, foreign experts need to understand the customs and laws of the country, especially tax obligations – to be able to integrate, adhere to and facilitate the work at local countries. In this article, we will indicate some regulations of Personal Income Tax that expatriates working in Vietnam should know.

What is PIT?

“Personal income tax” means the amount of money a person with income is required to remit part of salary or other sources of income into the state budget.

PIT from wages and salaries of foreigners working in Vietnam

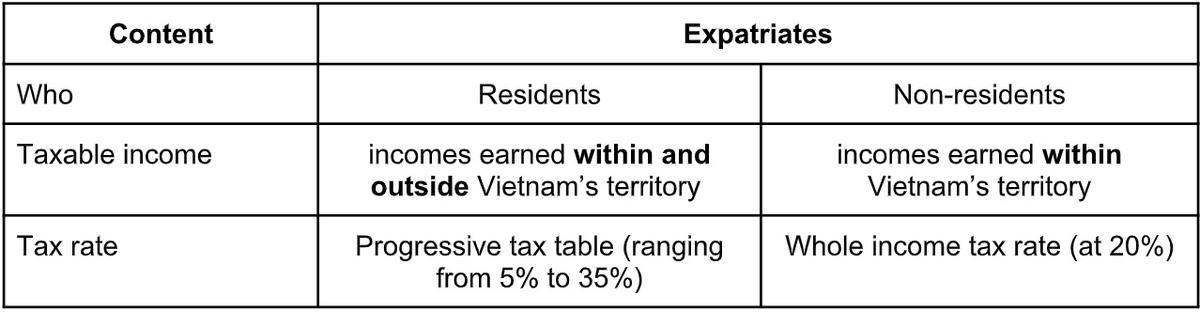

Within the scope of the article, we only provide guidelines on personal income tax from wages, salaries of foreigners working in Vietnam. An overview of the PIT regulations for foreigners can be found in the table below:

Taxable income is determined differently for 02 subjects: resident and non-resident.

Resident: who meets one of the following conditions:

- The person has been present in Vietnam for 183 days or longer in a calendar year, or for 12 consecutive months from the day on which that person arrives at Vietnam

- The person has a regular residence in Vietnam, including: (1) lives and has been registered as permanent residence, (2) The person rents a house in Vietnam according to regulations of law on housing under a contract that lasts 183 days or longer in the tax year.

Non-resident: who does not meet one of the above 02 conditions.

Taxable income, including:

- Salaries, wages, salaries, wages and other allowances.

- Benefits other than salaries and wages paid by the employer to which taxpayers are entitled in any form, including housing, electricity, water and other services for personal use Paying taxes, purchasing life insurance, membership fees.

Non-taxable income

1) Round trip airfare paid by employer (or payment) to foreign workers in Vietnam for annual leave (clearly stated on the TB contract). Flight and voucher for airfare from Vietnam to the country where the foreigner's family resides and vice versa).

2) The tuition fee for children of foreigners working in Vietnam studying in Vietnam by kindergarten level from kindergarten through high school shall be paid by the employer.

3) Rent for foreigners paid by employers exceeds 15% of the total taxable income.

Notice: In case individual residents are expatriates who terminate their contracts in Vietnam before leaving the country, they must make tax finalization with the tax office.

Above are general guidelines on PIT on salaries and wages of foreigners working in Vietnam (excerpted from Circular 111/2013/TT-BTC which is supplemented and amended by Circular 92/2015/TT-BTC).

The application of these regulations requires specific advice on a case-by-case basis.

Contact Kaizen Accounting for our advice to help you review compliance and make a final settlement with the tax authorities.

dev administrator

Thursday, 2020 03 05 10:16