General Tax Obligations Of Foreign-Owner Corporate in Vietnam

Tax and legal laws are complicated. It may cause foreign investors a big problem if they ignore it.

Particularly, tax obligations and tax benefits in Vietnam are always the significant concerns of investors who would like to do business and establish an entity in Vietnam, especially to foreigner organizations or individuals.

Most business activities and investments in Vietnam will be affected by the following taxes:

- Business license tax

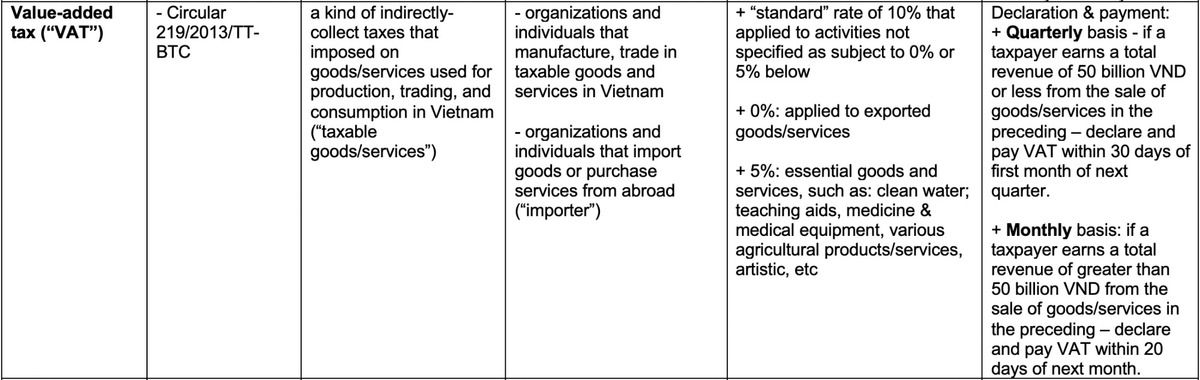

- Value Added Tax (“VAT”)

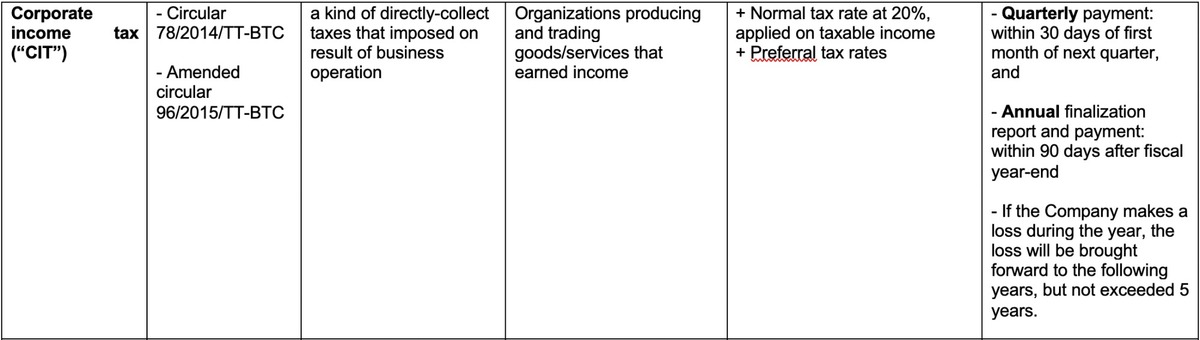

- Corporate Income tax (“CIT”)

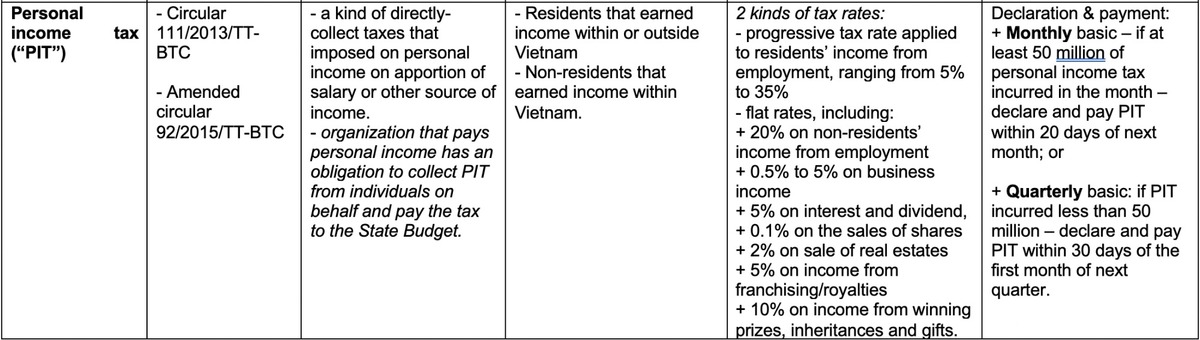

- Personal income tax (“PIT”)

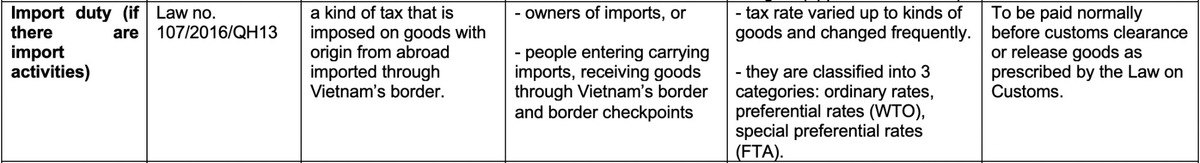

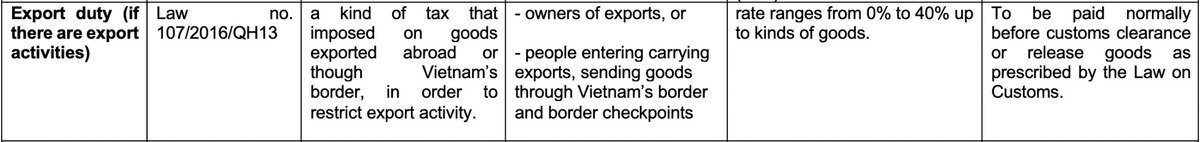

- Custom duties (if there are any import/export activities)

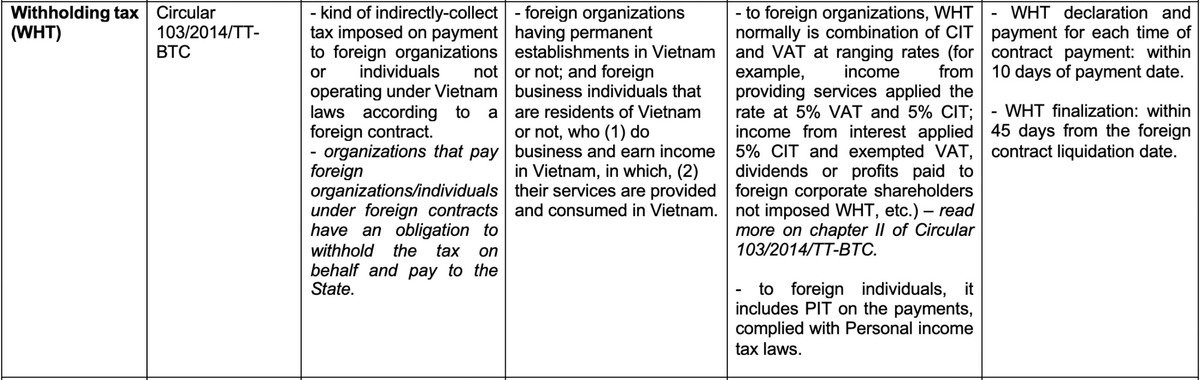

- Withholding tax (or foreign contractor tax)

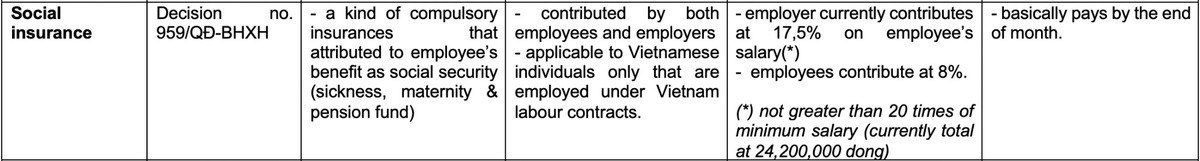

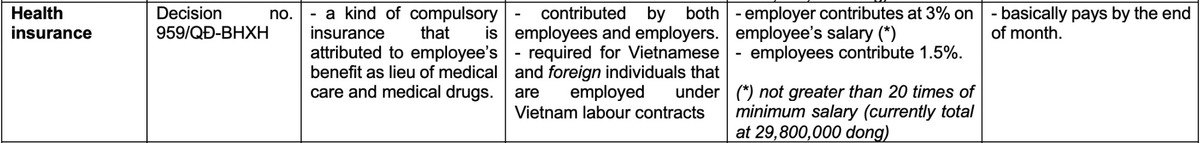

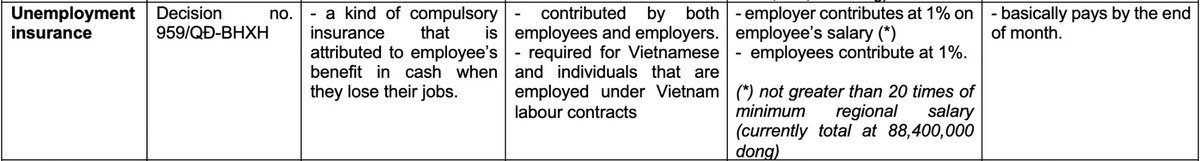

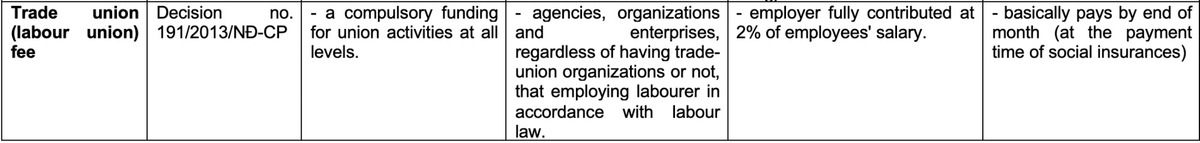

- Social Insurance, Health insurance, Unemployment insurance contributions, and Trade-union fees.

- And some specific taxes applied for certain specific activities such as: special sales tax, natural resources tax, property taxes, environment protection tax, that would not be mentioned in this article because of its rare occurrence in normal business.

In this article, we would like to mention on Vietnam tax obligations of foreign-owner enterprises operating in Vietnam, normally including:

The above guidance is just in general. Contact Kaizen Accounting to reduce your tax risks, take your tax advantages in specific transactions & ensure tax compliance for your business in Vietnam.

dev administrator

Wednesday, 2020 03 04 11:15